What is a lease with option to buy?

Imagine you are driving down a road, and you end up staring at the perfect house. It is ideal in every sense of the word, and you wish to buy it right now. However, there’s only one catch: you are not yet eligible for a mortgage and do not have enough savings to make a down payment. Can you still purchase the house? If not today, then at a future date? The answer is YES!

A lease with option to buy (also called lease to buy option or rent to own agreement) allows a buyer to rent out the property with an option to buy it at a later date. The agreement has two parts: a lease rental agreement (for rent) and a purchase agreement (for buying the property later).

Understanding the Contract

While this option allows potential homeowners – not eligible for a mortgage – to secure a house immediately, things can get tricky quickly. So, it is crucial to go over the agreement carefully. The agreement typically contains the following.

Acquisition Price

It is the price for how much the buyer will purchase the property at a future date. You can either lock a price today for the property you are buying, which makes sense if you expect the property to appreciate. On the other hand, you can choose the market value of the property when the lease expires as your purchase price.

Duration

The duration is the period you agree to buy the house in, typically extending from six months to three years. You need to be careful in choosing the duration as you will need to secure a mortgage during this time if you plan on buying the property.

Option Fee

An option fee is what the buyer asks you to pay upfront to purchase the property later, and it ranges between 1% to 5% of the purchase price. On the other hand, the downside is that option fees are non-refundable, so the seller gets to keep your money even if you don’t buy the property after the lease is over.

Rent Credit

It is the over and above rent amount that will go towards your down payment. A rent credit helps you transfer a certain percentage of your rent towards a down payment which comes in handy in securing a mortgage.

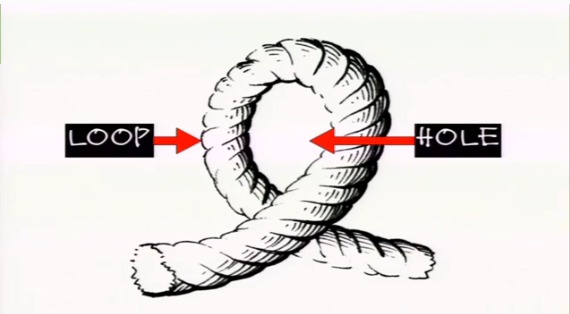

Identifying Potential Loopholes

While the seller prepares the agreement, you need to keep a close watch on the terms, so you don’t get ripped off down the line. Many clauses can hurt your interest and finances, such as:

- Who’s going to pay for repairs and maintenance during the lease?

While you are going to buy the house in the future, it is still the seller’s house that makes it their responsibility to pay for costly repairs.

- If you make a late payment, will it breach the contract?

A seller can keep the option fees and rent credit if there is a breach of contract, and you need to be thorough in what constitutes this breach. If a clause states a late payment will breach the agreement, you need to be very careful to pay your rent on time.

- Will your rent credit count as a down payment?

Many lenders may ignore your rent credits that you have been religiously paying as a down payment, so you need to be extra careful when drafting the agreement.

Building A Safety Net

To avoid such loopholes and downright scams, it is advisable to have a lawyer in the loop. Having the home checked through a professional home inspection is another recommended step that can save you hundreds of dollars down the road. You should also ensure that the property is legitimate and the taxes are up to date before signing the agreement.

Benefits Of Lease With Option To Buy

You can enjoy several benefits with Lease With Option To Buy as a buyer, the first one obviously being buying your ideal house without a mortgage in place. You can also lock in a price at the time of agreement and buy the house later, benefitting from appreciating house prices. You can avoid the hassle and costs of moving again and again as you will buy the same place you are living in.

For a seller, benefits include a steady flow of income throughout the lease period. The tenants also tend to be more careful with the property as they will be the new owners of the house. If the contract is breached, the option fee and rent credit go into the seller’s pocket with no questions asked.

Conclusion On A Lease With Option To Buy

Now that you understand what a Lease With Option To Buy means, you can make an informed decision whether it is right for you. It allows you to buy your dream house without mortgage requirements or down payments. However, if you cannot secure finances within the duration, you can lose your option fee and rent credit.

You should step cautiously and take professional coaching help if you are going with this option to make sure you are not losing money or signing a contract that will backfire. However, this option does allow you to purchase your dream house quickly, and as they say, don’t wait to buy real estate, purchase real estate, and wait!

How are you Ms Powell? I am interested in realty business and eager to get started with no experience.