Good credit makes it easy to get into real estate. Getting loans or mortgages for real estate requires a good credit score. Before institutions give out loans, they calculate the credit of each applicant. You could benefit from ways to improve your credit score.

There are a couple of brands whose platforms are used to generate a credit score. FICO, Experian, TransUnion, and Equifax.

The score used is generally between 300 to 850. An excellent credit score to get into real estate is between 750 to 800. A score of 700 is likewise acceptable in some situations. A credit score is calculated based on a number of factors. The score builds up over time and through years of account use.

There are some key ways or criteria that all the credit calculating brands use. Here are some:

- Late Payment of Bills. This includes how recently a late payment happened and how late was the payment.

- Experience using different types of accounts

- Your frequency of credit application over a year.

These are the basics considered and assessed by the credit score bureau. The good thing is that there are steps to take to improve your credit. Here are 5 good steps to take.

Avoid Late Payments

Late payment affects the credit score negatively. So it’s best to always stay on top of your payment and make loan repayments timely. The timely payment shows the lender you are trustworthy and can be trusted.

According to FICO and a majority of credit score brands, timely payment history accounts for 35% of the credit score. Do well to avoid late repayment and foreclosures. Even when it’s not regular, a history of late payment can taint your record and reduce your score.

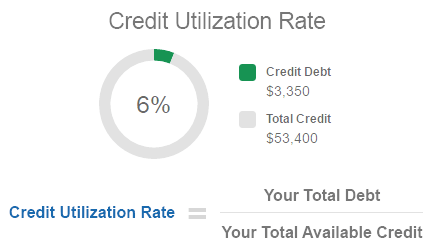

Reduce the Credit Utilization Rate

Available credit takes up to 30% of the credit score. Together with payment history, both accounts for 65% of the credit score. This shows why it is important to focus on both. Accounts owed category is always assessed. It includes credit card balances and limits. The relationship between these two is influences your score. A rule of thumb is to pay off credit balances and in full. Additionally, ask your credit issuer to increase your limit to help improve your score.

Attach to an Account of a Family Members

The age of an account also takes about 15% of the credit score. The age of your oldest account or the account to which you full access weighs in on your score. Usually, this category can not improved or hasten since it grows naturally. The date you opened your accounts will determine the age it carries. However, there is a way to tweak this category safely. To do this, speak to a family member who has an account that is a lot older and of course, credible. The family member will most likely be advanced in the age to have an account that will have lengthened history. Simply tell the family member to add you to the credit card of such an account as an authorized user. Such an account will be assessed and calculated as part of your account.

The caution here is to ensure the account is in a good shape. Also, do not be tempted to use a stranger’s account for this. Some companies may offer this type of service for a particular fee. However, being connected to the account of a stranger may be deemed fraudulent if you apply for a loan.

Self Reporting

For someone with low or almost non-existent credit history, self-reporting could be helpful. These big credit bureaus — Equifax, TransUnion, and Experian can not be linked to your utility payments. To, however, let your regular payment for utility, and other payments reflect in your credit score, you can self-report to some brands that will connect your good payment and balances to the credit bureaus. RentTrack, PayMyRent, UltraFICO, and Experian Boost are data furnishers that can be used to track your payment relay it to the credit bureaus. When self-reporting, keep the savings account in good condition with a reasonable balance at all times. Additionally, keep the payment history positive.

Keep in mind that self-reporting platforms may charge a service fee for the information they relay to credit bureaus. So do a good check to verify if some key places where you pay services are also furnishers.

Avoid Frequently Applying for new Accounts

A hard inquiry can be incurred if you request a new line of credit too often. A hard inquiry will affect your account for the first year of application and remain on the account for two years.

It’s best to be certain of your chances to get a new credit card before applying. If you are denied, your credit will be affected. Additionally, avoid frequent and repeated loan requests in a short period.

To know the state of your credit score, do well to check it regularly and spot areas where you can improve.

Thank you. I know my credit score and am currently working on it!