Real estate investors yearn for huge returns on their investments. Long term continuous profit is the advantage of real estate investment that attracts many who are looking to create extra income to cater to household needs, create a startup, or to save for rainy days. As profitable and plausible as real estate investment can be, it’s all too easy to fall short of some regulations and go bankrupt due to legal problems. For this reason, real estate investor asset protection is crucial.

Risk Factors For Real Estate Investments

Several problems can affect the revenue of property investment, but not all can bankrupt an investor as does a lawsuit.

Lawsuits are the types of risk factors in property investment that may result in bankruptcy. And these draining legal battles may result from property damage or injuries to tenants. When this happens, you may need to pay damages because you are accountable to the law for some accidental problems on your property.

While you may try hard to meet all requirements and avoid problems, not all can be avoided. You simply can’t anticipate all types of problems! But, there is, however, one thing you can do; protect your business to avoid bankruptcy and total loss of your assets.

Here are four good steps to protect yourself, personal assets, and limit the negative impact of lawsuits on your real estate investment:

- Insurance for your properties

- Compartmentalize your properties

- Creating shell companies

- Creating anonymous trust

Let’s look at these steps as protective layers and the capability of each. Additionally, each step will include a scenario that will give a clear picture and a thorough understanding of how you can benefit from them.

1: Insurance For Your Properties

Insurance should be part of your layers of protection, in fact, your first line of defense. Depending on the plan you subscribe to, insurance can protect your property from lawsuits involving accidents and damages. Keep in mind that while insurance companies may win some legal cases, some may require settlements. Regardless, your insurance will cover a large part, if not all of a settlement fund- depending on your policy.

However, do not for once think insurance is an excuse to be negligent. Some cases that result from obvious sheer negligence or avoidable instances may not be covered by most insurance policies and programs. Well, now you may start to see why insurance is the first line of defense- it’s vulnerable and has ample loopholes.

Here’s a scenario:

Your tenant in a storage facility may lose a certain amount of goods due to electrical faulty, or a tenant may fall over a rail in a residential property. It may lead to little loss or short-term injury. When this happens, a lawsuit may require you to pay around the neighborhood of $10,000 to $20,000. In this instance, your insurance policy will shield you and prevent the need to spend.

However, if the accident either at the storage or residential property results due to your negligence to put mandatory measures in place, then your insurance company may not pay. Especially when the lawsuit is high; your property will suffer a huge fine.

2: Compartmentalize Your Properties

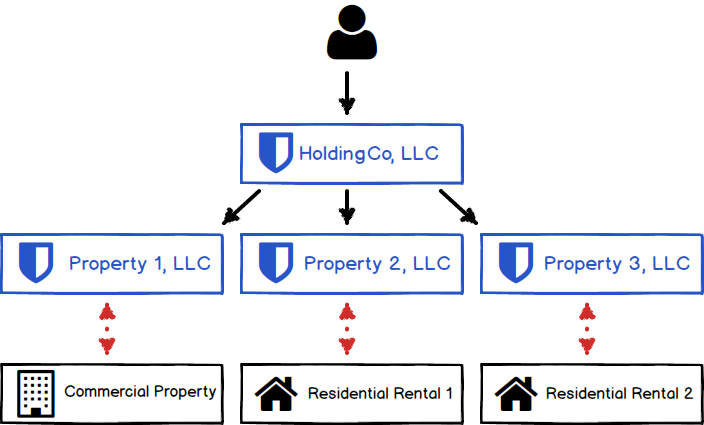

Another property protective layer is compartmentalizing properties by registering them as series LLC (limited liability company). This is advisable if you have real estate investment in different sectors and they’re quite many. So, simply split them into smaller units, and register each unit as an LLC.

What exactly is LLC and how does it help your property investment?

Simply put, a limited liability company separates a business from personal assets. In that way, when there is a lawsuit, only the business will be considered and targeted. Now, in series LLC which is applicable when you have different units of real estate properties, only an affected property unit will be touched in a lawsuit. And this provides a safeguard for other units of property owned by the same person since they are under another LLC company.

Here’s a scenario:

Suppose you own residential properties in two regions. So, you register each as a different LLC; say property 1 and property 2. Now, if a lawsuit is filed against property 1, your fine or settlement will be based on property 1 alone. Prosecutors can’t come after property 2 or personal assets.

3: Creating Shell Companies

Creating a shell company is very similar to the series LLC discussed above. Shell companies are usually without real assets- a perfect face for your business. It allows you as a real estate investor to keep your business separate from personal assets. It’s often regarded to as traditional LLC. It legally conceals the real net worth of your business and helps you avoid bankruptcy during a lawsuit as it also shields your assets.

Here’s a scenario:

Suppose you own properties. In this case, unlike the series LLC that you split into units, properties here are just under a unit. So, when there’s a lawsuit, your business “A” which is registered as a traditional LLC and run by a shell company will only suffer the impact. Every other asset and business is exempted.

4: Creating Anonymous Trust

Anonymous trust offers both protection and privacy- an excellent way to protect your net worth from legal prosecutions. You remain confident and not shaken when any part of your real estate property faces legal problems.

An anonymous trust prevents your name from being tagged or associated with a property. In this type of arrangement, trustees will be provided and their names would appear on all legal documents; not yours( the real owner).

It’s usually advisable to create an anonymous trust before creating a series LLC for added protection. In this way, a unit of your property has a different owner’s name from another.

Here’s a scenario:

Under the anonymous trust, it’s impossible to connect one property to another. So, should a tenant have legal battles with you as the owner, all of your property in an anonymous trust is exempted since they carry a different owner’s name.

Say ‘Yes’ To Real Estate Investor Asset Protection Strategies

Overall, never underestimate how much you can lose in a lawsuit, a worst-case scenario could leave you bankrupt. To avoid this, always incorporate the different layers of protection discussed above. Due to the loopholes and limitations of some, you may need to combine two or more; you can never err on the side of caution.

Looking for more helpful real estate investing information? Check out our blog on Five Real Estate Networking Tips. Also visit The Wealth Connect for training materials and courses designed to help you build a real estate investor career.

This is some very useful information.

This is great info! I really appreciate you sharing your great wealth of knowledge!

Thank you!