Investing in commercial real estate (CRE) is a popular investment method known for its consistent and growing returns. A major reason why many delve into real estate is due to its long-term benefits, good growth prospect, and profits.

As the real estate sector continues to make waves, investors are becoming many. Around the World, the ability to invest in real estate is on the increase, causing some to neglect critical reality checks, leading to costly decisions.

While commercial real estate is profitable, all real estate investments are not parallel. An investor needs to learn when to invest and how to invest in commercial real estate. This knowledge will help investors understand the risks, pitfalls to avoids, and common mistakes when making a purchase.

Here are key things to keep in mind before investing in commercial real estate.

Properties are different

Real estate has many categories. While the collective name is real estate, there are different types; the industrial real estate, office, multi-family, retail, medical, self-storage, and many more. Now, each of these types of real estate varies in the aspect of demand and profitability.

The changing conditions of the world how each of these types of real estate performs. An investor needs to research carefully to see the demand for each. Due to varying circumstances, some perform better than others.

Consistency also varies; while a particular one may perform well at a point, subsequently the demand may fall and consequently affect profitability. To check the demand for each type, some use property index reports. The index gives insight into how each asset type is performing at the present and the potential for growth.

The industrial real estate sector tops the chart in performance rank which makes it a safe investment plan. Now, performance may drop, and this a reason why constant research and evaluation are necessary. For example, there was a time when the retail sector was booming and performing greatly. But due to the advent of online stores, retail assets have suffered a huge decline. Something similar may also happen for asset types with a single tenancy structure rather than a multi-family type. For example, in storage facilities or warehouses; the vacancy period may be prolonged between the period an existing occupant leaves and a new comes around.

Overall, an investor should do a thorough evaluation of an asset type before going all in.

Learn the market pattern

The real estate market has a pattern that each investor needs to learn and understand properly. As mentioned at the outset, there are pitfalls to avoid. Investing ignorantly can lead to huge and devastating loss which may be difficult to recover from, and can discourage future investment opportunities.

Some asset types are affected by economic events. By learning these events, an investor will not purchase properties at a high price and then be forced to sell low.

Understanding the principle of supply and demand in real estate

The fact that a particular sector of real estate performs well in a region isn’t a green light to dabble into it. The supply and demand in a region may support the growth of some assets. However, it may be entirely different for another region. So, to evade loss, checking the demand and rate of supply will prove beneficial.

Before venturing into some commercial real estate plans, an investor will study the level of demand and ask questions like:

- How high is the demand?

- Is the supply saturated?

- What is the potential growth of the sector in the years to come?

A careful evaluation will provide the answers that will help determine if the asset type is worth the risk. Also, taking developing competition into consideration is likewise essential.

Be thorough

Spotting a promising opportunity can get an investor all excited. A true, good investment is good business, but a microscopic check is crucial. Some properties though having high demand and low supply may have some have hard-to-notice drawbacks. That is why investors are encouraged to review the tax records, profit & loss statements, and other related financial records of previous owners. Doing this helps to prevent costly mistakes that may result in loss.

In some cases, may not be as profitable as it may seem. For example, a property that looks perfect for a purpose may not work out as planned if zoning may disturb the use of such property. Or for some, it may be municipal permit cost that may be the hindrance.

So, to avoid investing and running at loss, it’s best to look for investors who have made purchases on similar properties. Alternatively, speaking to referrals can as well be helpful. Some may have worked with individuals who have invested in similar properties in the past.

In some cases, running a background check may be necessary especially when dealing with someone in the private sector.

Plan for unforeseen occurrences

When investing in properties directly, endeavor to plan for delays. It’s easy to have a fixed time in mind when renovations, new construction, and all other steps towards preparing is ongoing. However, some unforeseen occurrences affect the plans and slow down progress significantly. So, an investor needs to evaluate possible delays ahead of time and look for ways to manage and cope with such problems.

Even in cases where the investment is passive, setbacks can still deter progress. For such instances, an investor needs to realistic in terms of profit expectations. Usually, the fund manager may have laid bare the risks that can lead to fluctuation of assets, so an investor does well to use this information to plan for delays and possible disappointments.

Prepare a contingency budget

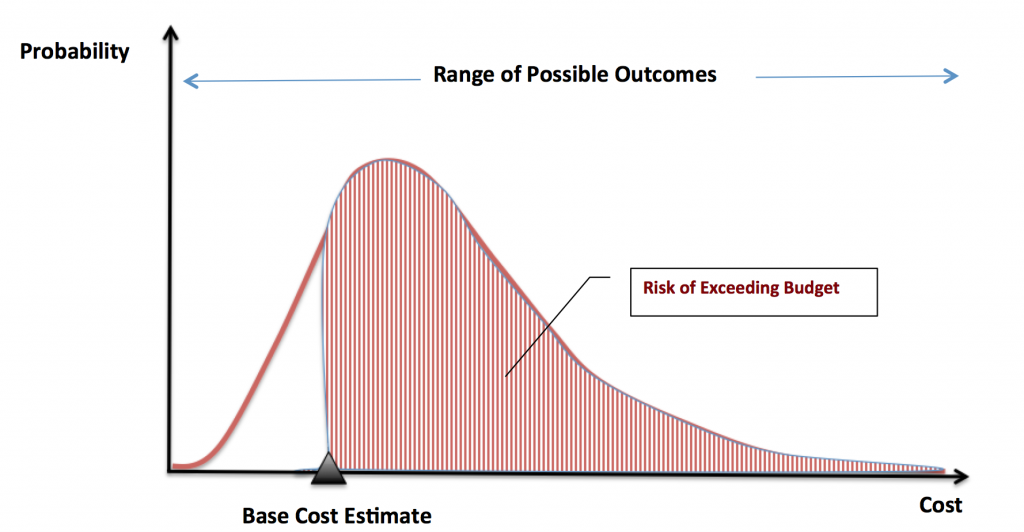

Despite the amount of research; the vetting, and evaluations, some unknown conditions may arise and can affect an investment adversely. Of course, sometimes unknown factors can also bring about a positive impact. But preparing a contingency budget is suitable for the bad times.

A contingency budget will take on unexpected expenditures that may arise in the course of acquisition. So, while there is a budget for the acquisition of a property, a contingency one is prepared alongside to take care of surprises until the property becomes ready to start bringing returns. A 3 to 5% budget is ideal.

Want More Information About Investing In Commercial Real Estate?

The points above are best considered before investing in commercial real estate. They will help you as an investor to prevent avoidable loss in commercial real estate. Although not all problems can be avoided, obvious types will definitely be prevented!

I’m really looking forward to this!!!

That is good info, I’m interested