When it comes to building wealth, there is no doubt that investing in real estate is one of the primes vehicles that will carry you the distance. It is no secret that real estate has created more millionaires than any other investment vehicle. However, there are tons of questions and gray areas that make it hard for newcomers to jump into the market.

You’ve maintained a great credit score, put away a little bit of savings, and you’re starting to see areas in your local market go up in value….but how do you join in on the action without having access to tons of cash and resources?

Today, I’m going to dive into a few ways you can invest in real estate with little to no money down. Make sure you take notes!

When it comes to banks and other traditional lending options, they all seem to want a ton of cash investment before lending. It makes sense when you think about it….

The more money you put in the less financial risk they incur.

But what if you don’t have the kind of money they are asking for? Here are a few options you might want to look into.

#1: Lower Upfront Money-Down Loans

Not every lender is the same. Most have programs that don’t require you to invest/tie up large amounts of capital. For example, Fannie Mae only requires 15% down with a good credit score. This could save you $10,000 or more in upfront costs depending on the property and your local market.

However, using these kinds of loans will require you to purchase private mortgage insurance. Which means less cash in your pocket each and every month. The upside is that when the property has appreciated and the loan balance has become lower than 80% of the property value, you can apply to reduce or eliminate this fee completely.

# 2: Line of Credit as Down Payment

If you’re low on initial capital, you can borrow the cash you need for your down payment, closing cost, and repairs, as long as you secure this loan with a different property. I.e, home equity lines of credit, or HELOC.

This option does require that you already own property. However, in an appreciating market, many homeowners actually have unused equity that is just sitting there instead of being put to work!

Another pro is that this cash does not have to be seasoned and sit in your account for months before putting it to use. You can borrow it right before closing. Just make sure that your property’s cash flow can sustain the payment on the line of credit. If it doesn’t, don’t do it!

#3: Use Local banks and Credit Unions

Tons of investors swear by credit unions and banks, however, their loan products aren’t that different from #1 above. The only exception is commercial loans.

If you have an existing business or an LLC that you use to flip houses, you might be able to get a loan with more favorable terms or even a line of credit to finance new investments.

#4: Seller Financed

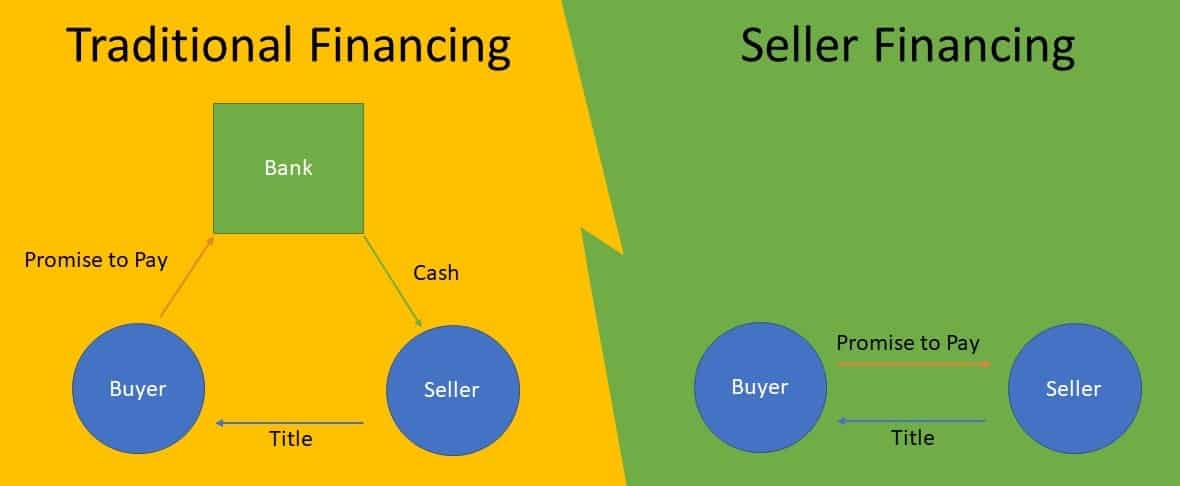

You may have heard of seller financing, land contracts, or subject-to-deals. These types of options are not easily found on the traditional MLS or with off-market properties unless you are actively advertising and bringing in leads of motivated sellers.

However, if you come across a seller that does not want to go the traditional route of publicly listing their property for sale, it is possible to negotiate a deal where you put down 10% and then make monthly payments to the seller vs taking out a loan and meeting their required down payment requirements.

#5: Seller Financed Closing Costs

If you are closing on a property, most lenders will not let you borrow any of the closing costs. However, the seller can usually pay for some of them, normally up to 2% of the total purchase price.

This is another option you can negotiate when making your offer. The seller is more likely to take you up on your offer when there is something unfavorable about the property or if the market isn’t hot.

You can also try raising your initial offer to cover the closing cost, just make sure that the appraisal will justify the additional cost.

#6: Wholesaling

A common entryway for new investors is real estate wholesaling, Wholesaling doesn’t require a high credit score or large sums of money down. Instead, you just have to have the right numbers in place to make the deal lucrative. In short, real estate wholesaling comes consists of finding discounted properties, assigning the contract to a potential buyer and then taking a percentage of the final closing for yourself.

This method does take a bit of work, however, almost zero capital is required to get started. You just have to develop a system and work those leads and get those contracts!

Investing In Real Estate and More

Knowing your credit score and credit history will help you narrow down and decide on the best investment strategy for you. The higher your credit score the more options that are available to you. Regardless there are many, many ways for you to jump into real estate regardless of your current credit score or finances. These are just a few options. I have written a complete book that covers every option and how you can use them to your advantage.

Hey! I could have sworn I’ve been to this blog before but after browsing through some of the post I realized it’s new to me.

Anyways, I’m definitely delighted I found it and I’ll be book-marking and

checking back frequently!

Thank you so much for the kind words, it’s always my pleasure to share my knowledge with others!

whoah this blog is magnificent i like studying your articles.

Keep up the good work! You recognize, a lot of

people are hunting around for this information, you can aid them greatly.

I am always glad to be of help, thank you!

It is perfect time to make some plans for the future

and it is time to be happy. I have read this post and

if I could I wish to suggest you few interesting things

or tips. Perhaps you could write next articles referring to this article.

I wish to read more things about it!

Thank your for the tips!

I’m impressed, I have to admit. Rarely do I

encounter a blog that’s both equally educative and

engaging, and without a doubt, you’ve hit the nail on the head.

The issue is something which not enough people are speaking intelligently about.

I’m very happy I found this in my hunt for something regarding this.

Thank you for the support

Its such as you learn my mind! You seem to grasp a lot

approximately this, such as you wrote the ebook in it

or something. I think that you simply could do with some % to power the message home a bit, however other than that, that is great blog.

A fantastic read. I will certainly be back.