One of the best ways to invest is by purchasing real estate, like a good rental property. This smart business move keeps generating stable and long-term revenue—a great way to vary one’s investment plan. A general rule of thumb in this type of investment is to avoid expecting quick returns; rental property is not a fast money scheme.

The whole process may sound easy and simple, but there are a couple of risks involved. Such risks can affect the calculated and anticipated profits, and in some cases, some properties may start to drain money rather than increase it. To avoid this, an investor needs to learn the type of rental property to purchase, and factors that determine a good and promising property.

There exists an established mantra that guides every investor to make the right choice when looking to buy rental properties. Below are important and accurate pointers to decide what type of rental property you should purchase.

A Booming or Growing Location

The location of a property weighs heavily on how it will perform. A rental property needs a good location with good demand to make it as profitable as expected.

A poorly located rental property will affect demand. For example, a rental property in less developed regions will bring in fewer returns because the demand for such a property will below. At the same time, the value placed on it will also be affected since the low demand will affect the value people are willing to pay for such property. Even in a city with high demands, some locations will be higher than some—and this in turn affects returns even though both are in the same state. Here are factors that serve as pointers for a Good Location:

Good population size and growth: A region with an ample or big population signals the potential of being a good location. An added benefit is the growth of such a region. When the growth is continuous, it increases the population size which is good for business.

Low crime rates and good transportation: Every business thrives when the roads are good. It facilitates easy movement of goods and boosts the fast delivery of services. Low crime also adds value since every business owner yearns to trade in safety without incurring a loss. Additional factors are; low insurance fees, presence of social amenities, developing labor market, and a reduced number of rental property listings.

To ease the evaluation process, there analyzing tools that calculates the profitability of each community or region. With the help of these tools, an investor can decipher where to invest, and expect reasonable & steady returns.

Outstanding amenities

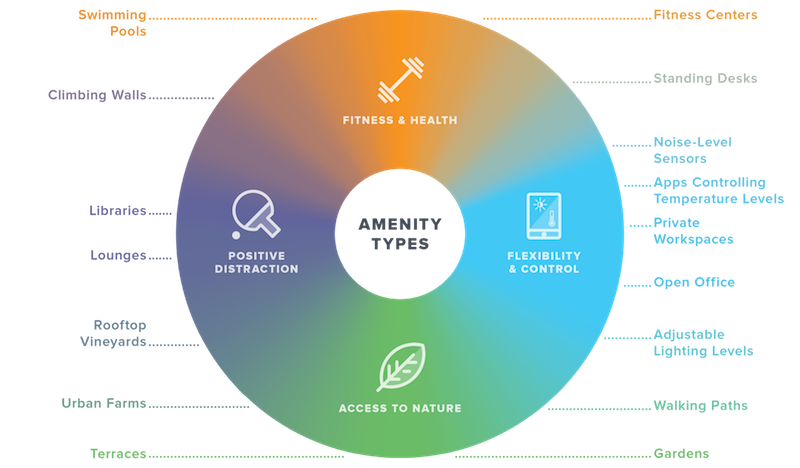

A rental property with good amenities attracts people. Everyone wants a place with features that gives comfort. Be it a residential or business structure, places with ideal amenities will win tenants over. For residential properties, amenities like extra space, modern designs, storage space, double bathrooms, extended living room, balcony, etc, make such an apartment outstanding and generates demand. For business rentals property, spacious parking lot, bigger storage unit, air conditioning, etc also attracts business owners looking to rent a place.

Single-Family Homes

Single-family homes are the best to start with if you are just venturing into a rental property. Purchasing this type of property is encouraged because they are affordable and easy to manage. Of course, there are other types of property. You may choose to invest in commercial property, condos, etc, however, single-family apartments are known to have long-term tenants, easy to sell, and this benefits an investor.

Excellent condition

Before purchasing a rental property, the condition is crucial. An investor needs to inspect a property before purchase. Check for any necessary repairs. It’s advisable to go with professionals who know what to check for, and how to check. It will help ensure if the facility has functioning amenities.

In reality, there might be some repairs, but it should be “few” such that you won’t start spending more than necessary from your emergency fund. So, even when a property is well situated, the condition must be reasonably good and not in a bad state that will require huge funds to repair.

Check your budget

One of the rules of investment is preparing a budget for each investment plan. The same holds true for rental property investment. Know how much you can afford, including an emergency fund. Doing this will help you find the property within the budget.

Do not be tempted to buy above your pocket, else it may affect you financially and even affect the ability to take care of emergencies like vacancy, etc.

Management

A rental property needs management to ensure a smooth running. It takes time, so, unless you’re ready to give it the needed time, hiring a property manager is necessary especially if the property is far away.

So, before making a purchase, endeavor to look for property managers in that region. At times some experienced property managers can be instrumental in finding an ideal rental property.

Good ROI

A good return on investment( ROI) must be calculated to see how much profit you’re making after considering the amount spent on emergencies annually. A good ROI automatically translates to positive cashflow. Usually, a positive cash flow indicates that you profit each month on your property. And by using a rental property calculator, you can do an analysis based on your cash flow to see how the property will perform long-term.

In terms of the annual returns on investment, there are online calculators that are easy to use based on the values you have over the months. Typically when the ROI is up to 8%, then it’s a commendable return.

Finding A Good Rental Property

Knowing how to purchase a good rental property involves considering all the discussed points. True, there are some situations where a property may seem not to meet all the requirements. Nevertheless, some important criteria are necessary to achieve success. It’s maybe best to meet with a professional property manager to get additional help regarding where compromises can be made. But to be on the safe side, always try to get a property that meets all the requirements.

This was very good knowledge for people who are beginning. Do you have any note on how to finance and find property?

Great advice. Thanks for this nugget of information!